November 9th, 2020, Kelowna, British Columbia – Enduro Metals Corporation (TSXV: ENDR OTC: SIOCF FSE: SOG-FF) (“Enduro Metals” or the “Company”) is pleased to report further drill results from historically unsampled drill core along the McLymont Fault of the Company’s Newmont Lake Project, providing additional evidence for significantly more gold within the previously drilled area. More assays are awaited from recent drilling which tested targets beyond the area of the historic drilling, including recently released NW20-09 which cut 8.85m of 31.09 g/t Au, and 1.07% Cu 300 metres away. The Newmont Lake Project is located in the heart of British Columbia’s Golden Triangle. McLymont is one of four large-scale geological systems on the 638 km2 project controlled by Enduro.

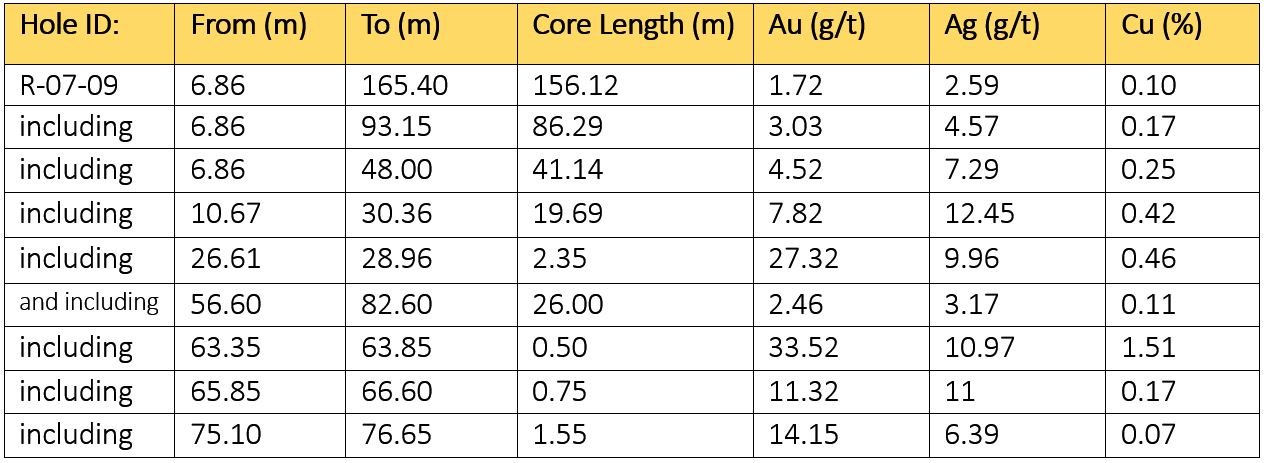

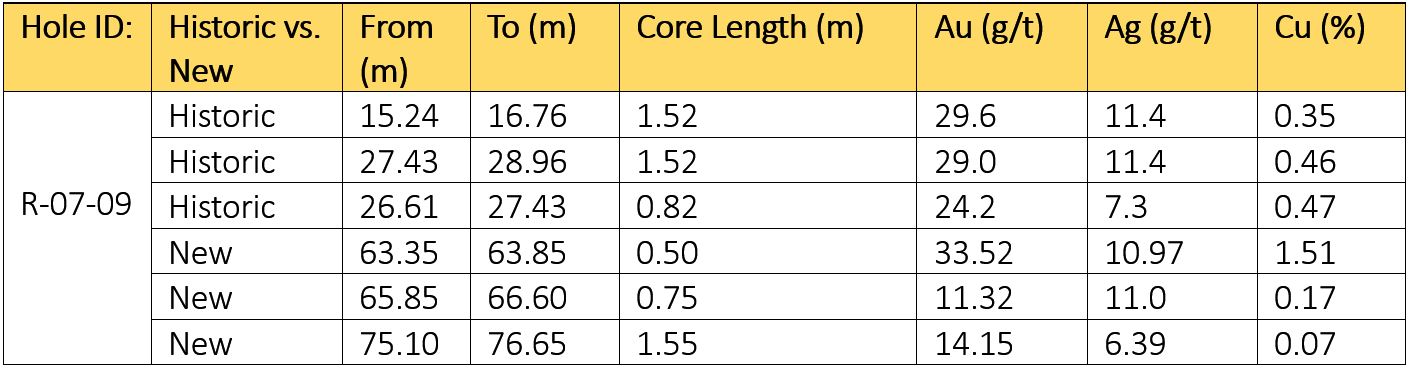

R-07-09’s original reported intersection was 19.69m of 7.82 g/t Au, including 2.35m of 27.32 g/t Au (see Romios Gold news release of December 18th, 2007). Enduro Metals took an additional 52 samples over a total of 83.08 metres from previously unsampled core. Of those 52 samples, 18 returned new anomalous gold values (see Figure 1).

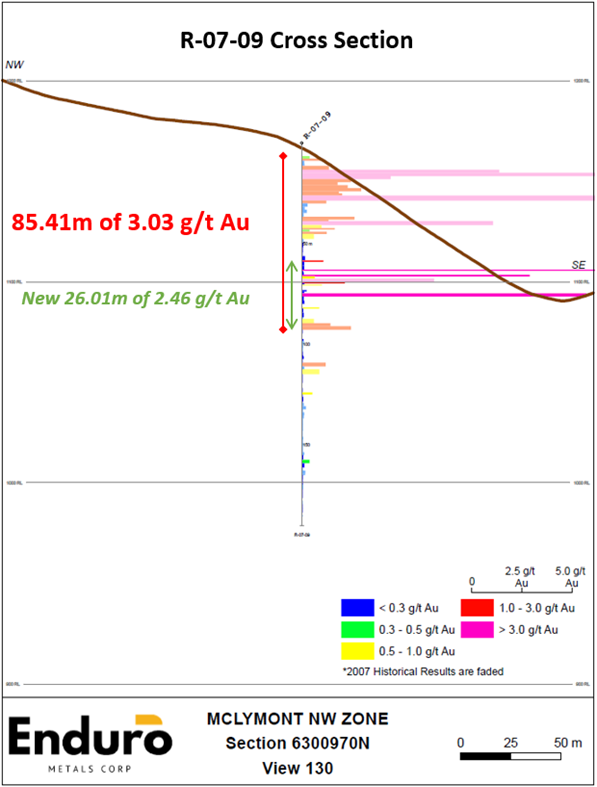

Assays below the original mineralized interval revealed another mineralized horizon of 26m of 2.46 g/t Au, 3.17 g/t Ag, and 0.11% Cu starting at 56.60m. Only 1 sample was taken in the newly discovered horizon when it was originally drilled in 2007 which returned 1.68m of 6.58 g/t Au, 29.6 g/t Ag, and 0.74% Cu (see Romios December 18th, 2007). The combination of these historic and new assays resulted in the longer interval of high-grade gold mineralization.

Historic diamond drill hole R-07-09, sampled at the beginning of the 2020 field season as part of the Company’s analysis of historic drill core returned a newly reported interval of 1.72 g/t Au, 2.59 g/t Ag, and 0.10% Cu over 156.12m starting at 6.86m depth, including 3.03 g/t Au, 4.57 g/t Ag, and 0.17% Cu over 86.29m (see Table 1).

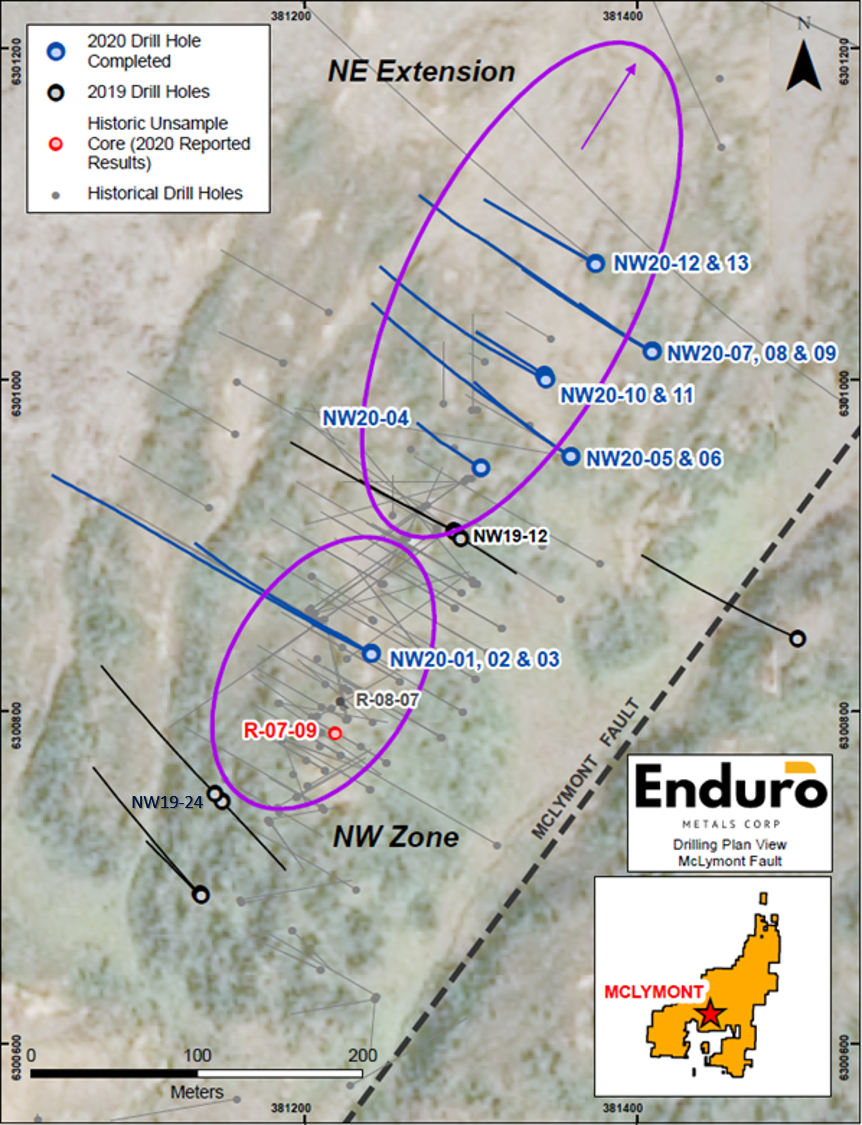

Diamond drill hole R-07-09 is a vertical drill hole in the NW Zone located:

- 25m south of previously reported R-08-07; another historic drill hole sampled as part of the historic sampling campaign which returned 144.00m of 3.18 g/t Au, including 0.44m of 753 g/t Au, 462 g/t Ag, and 0.69% Cu (see Enduro July 28th, 2020).

- 150m southwest of previously reported NW19-12 (drilled in 2019) which intersected 13m of 4.03 g/t Au and 0.29% Cu within 188.00m of 1.10g/t Au, 1.15 g/t Ag, and 0.09% Cu starting at 67.0m depth (see Enduro July 28th, 2020).

- 300m southwest of recently reported NW20-09 which intersected 03 g/t Au, and 0.36% Cu over 28.34m starting at 144.12m depth (see Enduro October 21st, 2020), including 8.85m of 31.09 g/t Au, and 1.07% Cu and 225.30 g/t Au, and 4.90% Cu over 0.59m.

Furthermore, on the opposite end of the NW Zone, non-material unreported drilling from 2019 encountered additional high-grade gold at surface 30m west of historic NW Zone drilling, along with increasing copper enrichment. NW19-24 intersected 3.54m of 6.10 g/t Au, 4.04 g/t Ag, and 0.16% Cu starting at 8.46 metres depth, including 1.09m of 15.82 g/t Au, 11.30 g/t Ag, and 0.42% Cu. This high-grade gold intersection is a 30m step-out to the southeast from the nearest historic drilling completed in 1987 which intersected 2.80 metres of 14.40 g/t Au, 14.20 g/t Ag, and 0.32% Cu starting at 5.60 metres depth.

NW19-24 is one of 4 short holes drilled in 2019 immediately southwest of the NW Zone which were drilled for geological modelling purposes (see Figure 2). All 4 short drill holes contain broader intervals of low-grade anomalous gold and copper currently being interpreted.

Current drilling along the McLymont Fault is 16km up the McLymont Creek Valley from the 303-megawatt Northwest Projects hydroelectric power complex, which is serviced by an all-season road access and is tied into the provincial power grid.

Cole Evans, President/CEO of Enduro commented, “The R-07-09 results provide additional evidence of previously unknown gold mineralization similar to results from R-08-07’s 144.00m of 3.18 g/t Au reported this past July. This suggests there is significantly more gold mineralization within the Northwest Zone than was previously understood over much broader intervals. Pending 2020 drill results will help develop the relationship between mineralization in the NW Zone and elsewhere along the McLymont Fault, including our recent success from NW20-09 in the NE Extension.”

Table 1: Summary of combined new and historical assays of R-07-09 detailing mineralization. No grade cutting was used.

Table 2: Summary of assays returning >10 g/t Au from R-07-09. True width is estimated to be >90% of the reported core length based on lithological modelling. R-07-09 was drilled vertically to a depth of 190.50m.

Figure 1: Cross Section of R-07-09 highlighting areas of gold mineralization, including identification of an additional high-grade gold horizon immediately beneath historic sampling.

Figure 2: Plan view map of 2020 drilling at the NW Zone and NE Extension along the McLymont Fault, Newmont Lake Project. Historic drilling completed by several previous operators largely between 1987-1990 is shown in grey. R-07-09 is a vertical drill hole completed to a depth of 190.50m in 2007 highlighted in red.

Historic Resource

The historic resource estimate from within the NW Zone is based on diamond drilling completed between 1987-1990 by Gulf Minerals with an estimate of 1,406,000 tonnes of 5.16 g/t AuEq (4.43 g/t Au, 6.4 g/t Ag, and 0.22% Cu) containing 200,000 oz gold, 291,000 oz silver, and 6,790,000 lbs copper contained within approximately 100m of surface at a “base case” cut-off grade of 2.00 g/t AuEq (see Mineral Resource Estimate on North West Zone, Newmont Lake Property, Romios Gold Resources 2007). 16,992m of diamond drilling were completed between 1987-1990, of which 3,382m was assayed for gold mineralization. Insufficient work has been completed to classify the historical estimate as mineral resources. No mineral reserves are contained in the historical resource estimate.

The existing mineral envelopes used by Gulf Minerals are based on the 1987-1990 drilling completed by Gulf Minerals (16,992 m total) and are indicative of a concentration of reasonably continuous, high grade, gold–silver-copper mineralization at the NW Zone. However, only 20% of the total core drilled was sampled and 2019 / 2020 drilling and resampling programs on historic core are now demonstrating that there is significant additional gold mineralization lying both within and outside of historic mineral envelopes which would not have been included in the historic estimate. Additional work is required to complete a new resource estimate for the NW Zone.

Summer 2020 Program Summary

During the 2020 summer exploration season, Enduro Metals completed:

- 4,688 metres of diamond drilling with 3396 core samples assays

- Collected and submitted 511 core samples from unsampled historic core

- 6,727 hyperspectral measurements of diamond drill core

- 2,500 hyperspectral measurements of field samples

- 850 soil samples

- 252 rock samples

- 15 metres of channel sampling

- 9 kilometres of induced polarization (IP) geophysics

- 4 square kilometres of 1:2000 scale geological mapping

The Company is currently awaiting, receiving, and/or interpreting results from the exploration work completed in 2020. The Company remains in a strong financial position. Plans for winter 2020/2021 operations will be announced once all reporting from the summer 2020 Program is completed.

Enduro Metals QAQC / Analytical Procedures

Core samples from the Newmont Lake Project were sent to MSA LABS’ preparation facility in Terrace, B.C., where samples were prepared using method PRP-910. Samples were dried, crushed to 2mm, split 250g and pulverized to 85% passing 75 microns. Prepped samples were sent to MSA LABS’ analytical facility in Langley, B.C, where 50g pulps were analyzed for gold using method FAS-221 (fire assay-AAS finish). Gold assays greater than 100 g/t Au were automatically analyzed using FAS-425 (fire assay with a gravimetric finish). Rock samples were analyzed for 48 elements using method IMS-230, multi-element ICP-MS 4-acid digestion, ultra-trace level. Silver assay results greater than 100 g/t Ag and copper, lead, and zinc greater than 10,000ppm were automatically analyzed by ore grade method ICF-6.

Enduro Metals Corp conducts its own QA/QC program where five standard reference material pulps, five blank reference material samples, and two field duplicates are inserted for every 100 samples when analyzing core samples.

Romios Gold 2007 QA/QC Procedures

As part of the sampling procedure, a QA/QC program was carried out to ensure accuracy in assay results. This program is outlined below. One of four (HLHZ, FCM-2, 3C and BL-3) standards from an outside laboratory (CDN Labs6 of Delta, BC – standard certificates are included in Appendix E) were inserted into the sample stream. BL-3 is a blank. The number of QA/QC samples taken for the summer 2007 drill program total 49, or 10% of the 498 samples collected and submitted to the laboratory. This QA/QC program was completed in addition to the internal QA/QC program done by ALSChemex Labs. Any failures in the standards or blanks were evaluated in the field for any field related errors, and selected failed batches were re-assayed by ALS-CHEMEX Labs to determine the validity of the original assays. Appendix E contains a breakdown of the QA/QC program. Results are within acceptable limits.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Maurizio Napoli, P. Geo., Director for Enduro Metals, a Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

About Enduro Metals

Enduro Metals is an exploration company focused on it’s flagship Newmont Lake Project; a total 638km2 property located between Eskay Creek, Snip, and Galore Creek within the heart of northwestern British Columbia’s Golden Triangle. Enduro entered into an option agreement to acquire 436km2 from Romios Gold Resources who has carefully amalgamated the area since 2005 from numerous smaller operators. Remaining terms on the option agreement are a $1 million CAD cash payment, and issuance of 8 million Common Shares to Romios Gold Resources. Romios will retain a 2% Net Smelter Returns Royalty (an “NSR”) on the Newmont Lake Project, or on any after-acquired claims within a 5 km radius of the original boundary of the project, which may be reduced at any time to a 1% NSR on the payment of $2 million per 0.5% NSR. The remaining 202km2 is owned 100% by Enduro and was acquired via staking or cash purchase. Building on prior results, the Company’s geological team have outlined 4 deposit environments of interest across the Newmont Lake Project including high-grade epithermal/skarn gold along the McLymont Fault, copper-gold alkalic porphyry mineralization at Burgundy, high-grade epithermal/skarn silver/zinc at Cuba, and a large 9km x 4km geochemical anomaly hosting various gold, silver, copper, zinc, nickel, cobalt, and lead mineralization along the newly discovered Chachi Corridor.

On Behalf of the Board of Directors,

ENDURO METALS CORPORATION

“Cole Evans”

President/CEO

For further information please contact:

Investor Relations

Sean Kingsley – Director of Communications

Tel: +1 (604) 440-8474

Email: info@endurometals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements”. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause Enduro’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this document include statements concerning Enduro’s expected use of proceeds of the Offering and all other statements that are not statements of historical fact.

Although Enduro believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by their nature forward-looking statements involve assumptions, known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the Covid-19 pandemic; adverse industry events; future legislative and regulatory developments in the mining sector; the Company’s ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of Enduro to implement its business strategies; competition; and other assumptions, risks and uncertainties.

The forward-looking information contained in this news release represents the expectations of the company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While the company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.