July 27th, 2020, Kelowna, British Columbia – Enduro Metals Corporation (TSXV: ENDR OTC: SIOCF FSE: SOG-FF) (“Enduro” or the “Company”) is pleased to provide additional information on the most recent technical press release on July 6th, 2020, as well as announcing Phase 2 exploration targets focused on high-grade gold targets along the >20km McLymont Fault within the Company’s 618km2 Newmont Lake Project located in the heart of northwestern British Columbia’s Golden Triangle.

The Company wishes to provide additional information with respect to historic diamond drill hole R-08-07 (“R-08-07”) reported in its July 6th, 2020 news release titled “Enduro Metals Reports Drill Intercept Cut 144 metres of 3.18 g/t Gold; Identifies Additional Gold Targets at Newmont Lake in BC’s Golden Triangle” and other historic results amalgamated. R-08-07 is interpreted to represent 3 gold mineralization styles as seen 150m to the NE in diamond drill hole NW19-012 (“NW19-012”) from the Company’s first exploration program on the Newmont Lake Project last season.

Further to the July 6th, 2020 press release highlighting the first continuous assay of a diamond drill hole from within the NW Zone, the Company wishes to reference further breakout of coarse visible gold identified within the shallow skarn horizon of vertically drilled historic R-08-07 discovered by Romios Gold Resources (“Romios”) in 2008 (see Romios September 22nd, 2008), as well as other occurrences of coarse visible gold within the general area. R-08-07 intersected ultra high-grades of 0.44m of 753 g/t Au, 462 g/t Ag, and 0.69% Cu starting at 25.25 metres depth. To account for unpredictability of coarse visible gold causing ultra high grades (considered >100 g/t Au), the following “uncut” and “cut” versions of the intercept are provided as a stress-test as well as silver and copper assays. Gold mineralization is consistent across the 144m interval demonstrated by cut gold assays results, but ultra high grades are sporadic and difficult to reproduce.

Table 1: *0.44m of 753 g/t Au cut by 90% to 0.44m of 75.3 g/t Au. True widths are unknown of mineralized intervals.

The Company has identified a total of 8 ultra high-grade gold intervals (>100 g/t Au) interpreted to represent coarse visible gold drilled within a 150m radius of R-08-07 reported in Table 2. The skarn horizon consistently intersects high-grade gold mineralization, but ultra high grades are erratic and difficult to reproduce in diamond drill core.

Table 2: Historic ultra high-grade intersects (>100 g/t Au) interpreted as coarse-grained visible gold as distinct grains in diamond drill core. True widths are unknown of mineralized intervals. The assay information provided in Table 2 has been verified by the Company’s QP using historic analytical reports from various 3rd party laboratories. It is noted that assay results in Table 2 are historic and historic sampling methods were not directly supervised by the Company’s QP. The Company’s QP supervised 2019 infield work which involved logging and assaying of some historic drill core not included in Table 2. Limitations exist with respect to verification of XYZ locational information of diamond drill hole collars due to lack of infield casing or casing cap markers.

A total of 436 km2 of the 618km2 Newmont Lake Project are subject to the terms of the 100% Option Agreement dated November 29, 2018 between Romios and the Company. The reported 144m intercept of R-08-07 is a collaboration of assays between Romios and Enduro amalgamating 3 factors: assays above 74.71m reported by Romios (see September 22nd, 2008), assays below 74.71m by Romios Gold previously undisclosed, and new assays below 74.71m provided by Enduro Metals (see Table 1). It is important to note that 61% of assayed material containing majority of gold mineralization was from 2008 work by Romios and a further 34% recently by Enduro. Dramatic changes to mineral economic factors resulting from gold prices increasing by 2.5x since time of drilling, gold prices increasing by 4.0x since historic resource estimates, and the construction of a hydroelectric powerplant 16km from the historic NW Zone leads the Company to believe that there is significant potential for more gold of economic interest within the historic NW Zone, in addition to extensions and new targets identified in the immediate area.

Romios technical teams found and historically reported multiple gold mineralization styles. Enduro has built upon this excellent work by advancing the understanding and has created the first lithological and geophysical models in the area suggesting 3 gold mineralization styles are present similar to what has been observed in R-08-07 and NW19-012 drilled 150m to the NE (see September 18th, 2019, Crystal Lake Mining). Newly reported mineralization below the skarn (75.71m) in R-08-07 is interpreted as broad, porphyry-like gold with high-grade “feeder structures”. Little is known about this mineralization style at this time as historic drilling focused on the shallow, high-grade skarn. The three styles of gold mineralization interpreted by Enduro in NW19-012 are shown in the following breakdown:

Skarn: 44.03m of 4.03 g/t Au, 4.06 g/t Ag, and 0.29% Cu starting at 82.00m

Epithermal: including 1.00m of 76.56 g/t Au, 11.54 g/t Ag, and 0.47% Cu starting at 111.35m

Porphyry: 77.15m of 0.30 g/t Au, 0.25 g/t Ag, and 0.03% Cu starting at 157.00m to EOH.

NW19-012 was stopped in low-grade porphyry-like gold mineralization at 256m with the final assay of 2.00m of 0.46 g/t Au, 0.27 g/t Ag, and 0.05% Cu. The hole was stopped as it was unknown at the time if the unit would carry gold. Assay data has confirmed this mineralization does carry gold in this location. Early indications from geochemical, hyperspectral, and geophysical data suggest mineralization and alteration may strengthen with depth if the drill hole is continued further.

Figure 1: Changes in white mica composition show highest gold grades in samples with absorption features between 2198nm and 2203nm on section of NW19-012 and NW19-017. Correlation demonstrates potential high-grade gold mineralization at depth in hyperspectral modelling. Elevated white mica crystallinity shows a spatial correlation with modelled high-grade gold “feeder structures”. Diamond drill hole NW19-017 (“NW19-017”) demonstrated a confirmation of this technique as it intersected high-grade gold feeders including 1.62m of 14.84 g/t Au within 18.31m of 1.80 g/t Au starting at 189.00m, and 1.50m of 9.33 g/t Au, 16.29 g/t Ag, and 0.82% Cu starting at 80.24m (see July 6th, 2020, Enduro Metals). Untested high-grade gold targets remain.

Figure 2: Mineral presence sections of NW19-012 and NW19-017 showing >85% correlation of gold mineralization with K-rich white mica and inverse relationships between gold mineralization and Mg-rich white mica and chlorite. Note these relationships are also consistent with elevated white mica crystallinity (see Figure 1), as well as intersected high-grade gold in NW19-017 (see July 6th, 2020, Enduro Metals).

Cole Evans, President/CEO of Enduro commented “I am pleased that stress testing on historic R-08-07 provides attractive cut gold grades in addition to the uncut intervals at shallow depths. I am also encouraged to see ultra high grades (>100 g/t Au up to 903.99 g/t Au) in historic assays exist both in the interpreted skarn horizon and deeper epithermal feeders.

Our data suggests more drilling is needed within these historic areas in addition to our new targets. The primary technical focus will remain on expanding gold mineralization with systematic step-outs away from NW19-012 along the NE Extension towards Goldfish which we have a high-degree of confidence in. Simultaneously, several other gold targets will be tightened up within the area as they are near drill ready. Drilling is planned to restart shortly with larger HQ diameter core and important oriented core data. Equipment is on-site ready to go. Our on-site technology and experience will allow the technical team to make quick infield decisions to accelerate exploration drilling as necessary. Grassroots exploration will also continue at Chachi as we move closer to drill targets in that area first discovered in 2019 with zero previous drilling. More updates will follow as information becomes available.”

Historic Resource

The historic resource estimate from within the NW Zone is based on diamond drilling completed between 1987-1990 by Gulf Minerals with an estimate of 1,406,000 tonnes of 5.16 g/t AuEq (4.43 g/t Au, 6.4 g/t Ag, and 0.22% Cu) containing 200,000 oz gold, 291,000 oz silver, and 6,790,000 lbs copper contained within approximately 100m of surface at a “base case” cut-off grade of 2.00 g/t AuEq (see Mineral Resource Estimate on North West Zone, Newmont Lake Property, Romios Gold Resources 2007). 16,992m of diamond drilling were completed between 1987-1990, of which 3,382m was assayed for gold mineralization. The historic resource is considered reliable as it was prepared by experienced resource geologists. The relevance is considered low as the “base case” cut-off grade was derived from $475 USD price per ounce of gold which is materially different from current gold prices. Additional work is needed if the historic resource were to be upgraded. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources and therefore the Issuer does not treat the historical estimate as current mineral resources or mineral reserves. No mineral reserves are contained in the historical resource estimate.

2020 Phase 1 Exploration Plans – McLymont Fault

The Company’s proposed 2020 exploration program will focus heavily on diamond drilling of high-grade gold targets with the following 4 objectives:

- Continue to step-out along the NE Extension.

- Test for parallel high-grade gold mineralization suggested by limited historic assays in 1989.

- Test for additional gold mineralization within the existing footprint at the NW Zone.

- Test for new gold mineralization centres along strike of the McLymont Fault.

Objective 1

Continue step-out drilling expanding the NE Extension on 25m to 50m centres based off results from the Company’s latest diamond drilling which intersected previously reported hole NW19-012:

- 188m of 1.10 g/t Au, 1.15 g/t Ag, and 0.09% Cu starting at 67.0m

- including 44.03m of 4.03 g/t Au, 4.03 g/t Ag, and 0.29% Cu starting at 82.00m

- including 1.00m of 76.56 g/t Au, 11.54 g/t Ag, and 0.47% Cu starting at 111.35m.

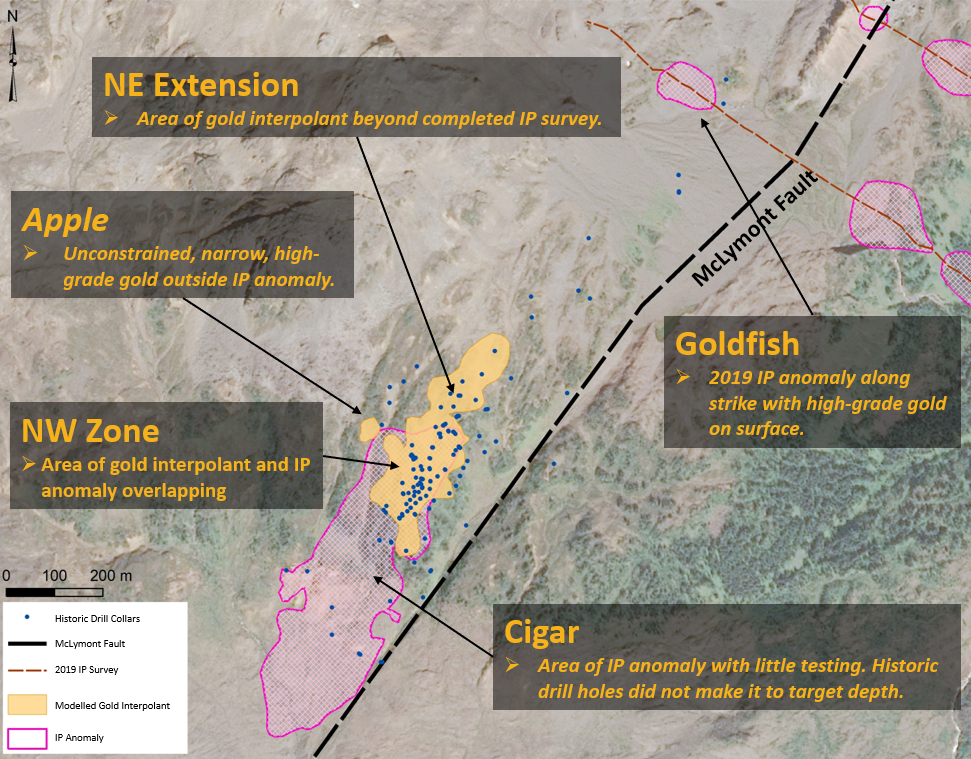

Interpolants have modeled gold beyond the limits of the current Induced Polarization (“IP”) geophysical surveying, and further exploratory and infill IP lines will further constrain targets between the NE Extension and Goldfish (see Figure 5). High-grade skarn mineralization remains open to the NE towards Goldfish. The 188m was not previously disclosed by Crystal Lake Mining on September 18th, 2019 and is reported by Enduro Metals as latest interpretations suggest the potential for calc-alkalic porphyry-like mineralization in the area.

Figure 3: Plan view showing relative locations of NW Zone, NE Extension, Apple, Cigar, and Goldfish along the McLymont Fault with simplified IP anomalies and gold interpolants.

Objective 2

Test the Apple fault block approximately 200 NW of the NW Zone. Limited drilling and sampling data completed in 1989 suggests the presence of a parallel zone of high-grade gold mineralization at Apple requiring follow up and additional testing (see Figure 6).

Objective 3

Testing for additional gold mineralization within the existing footprint of the NW Zone and beneath (see Figure 4 B-B’). Drilling specific to the NW Zone has not penetrated below 256m. Broad-low-grade gold remains open at depth dipping to the NW. High-grade gold “feeder structures” remain open to an unknown depth and unknown horizonal extent. Near-surface high-grade gold skarn mineralization remains open to the NE and SW and appears to be shallowly plunging to the NE. Few sporadic drill holes completed in 1990 drilled to the northeast between the NW Zone and Goldfish were drilled as deep as 676.3m. Limited historic data provides more evidence of gold mineralization along strike and extending to depth in diamond drill hole J-90-2 including 1.00m of 9.20 g/t Au @ 501m and the final sample of at 675m ending in 1.30m of 4.20 g/t Au, along with greater gold enrichment zones. These intersects are thought to be distal to the main target area with the Company’s new information and are approximately 400m NE of NW19-012. While testing for additional gold within the known NW Zone system, Enduro wishes to point out that any reference to “previous operators” is specific to those who operated between 1987 and 1990 who drilled the historic resource under extremely different mineral economic circumstances.

Figure 4: Plan view of A to D cross-sections along the McLymont Fault highlighting the current chargeability anomaly and area of planned infill surveys.

Objective 4

Test for new gold mineralization centres along the McLymont Fault, with interest in Goldfish. The recently discovered Goldfish Zone was identified in 2019 from a deep penetrating IP survey. Goldfish shares the same chemical and physical characteristics as the NW Zone including in-situ high-grade gold in rocks on surface, high chargeability anomaly, overlapping magnetic-low signature, and is importantly at a double-fault junction between the McLymont Fault and a >3km north-south trending conjugate thrust fault. This thrust fault is also spatially related to the Ken Zone; an area first identified by Newmont Mining Corporation in 1961 as being prospective for high-grade gold. Field work in 2020 will further delineate targets at Ken Zone and how it is possibly linked. Recent surface sampling identified high-grade gold, silver, and copper on surface including a chip sample of 4.0m of 11.22 g/t Au, 4.12% Cu, and 43.54 g/t Ag.

Figure 5: A-A’ cross-section stepping out along NE Extension.

IP geophysical surveying, historical logging/assaying, and reconnaissance of additional areas of diamond drilling interest will occur simultaneously to continue tightening the Company’s pipeline of quality exploration targets.

Figure 6: B-B’ cross-section designed to improve sampling through the replacement horizon and be the first test for down-dip high-grade gold mineralization. High-grade parallel trends may be present based on results from NW88-06 (0.6m of 39 g/t Au with no shoulder sampling) needing follow up.

Table 3: Locations of all drill holes discussed with July 27th, 2020 News Release.

QAQC/ Analytical Procedures

Rock samples from the Newmont Lake Project were sent to MSALABS preparation facility in Terrace, B.C., where samples were prepared using method PRP-910. Samples were dried, crushed to 2mm, split 250g and pulverized to 85% passing 75 microns. Prepped samples were sent to MSALABS analytical facility in Langley, B.C, where 50g pulps were analyzed for gold using method FAS-121 (fire assay-AAS finish). Gold assays greater than 100 g/t Au were automatically analyzed using FAS-425 (fire assay with a gravimetric finish). Rock samples were analyzed for 53 elements using method IMS-230, multi-element ICP-MS 4-acid digestion, ultra-trace level. Silver assay results greater than 100 g/t Ag and cobalt, copper, nickel, lead, and zinc greater than 10,000ppm were automatically analyzed by ore grade method ICF-6.

Enduro conducts its own QA/QC program where three standard reference material pulps, two blank reference material samples are inserted for every 100 samples when analyzing rock samples.

Soil samples from the Newmont Lake Project were sent to MSALABS preparation facility in Terrace, B.C., where samples were prepared using method PRP-757. Soil samples were dried and screened to 80 mesh, discard plus fraction. Prepped samples were sent to MSALABS analytical facility in Langley, B.C, where they were analyzed for 51 elements using IMS-131 for samples with 20g or greater and IMS-130 for samples between 0.5g and 20g.

Romios Gold 2007 QA/QC Procedures

As part of the sampling procedure, a QA/QC program was carried out to ensure accuracy in assay

results. This program is outlined below. One of four (HLHZ, FCM-2, 3C and BL-3) standards from an outside laboratory (CDN Labs6 of Delta, BC – standard certificates are included in Appendix E) were inserted into the sample stream. BL-3 is a blank. The number of QA/QC samples taken for the summer 2007 drill program total 49, or 10% of the 498 samples collected and submitted to the laboratory. This QA/QC program was completed in addition to the internal QA/QC program done by ALSChemex Labs. Any failures in the standards or blanks were evaluated in the field for any field related errors, and selected failed batches were re-assayed by ALS-CHEMEX Labs to determine the validity of the original assays. Appendix E contains a breakdown of the QA/QC program. Results are within acceptable limits.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Maurizio Napoli, P. Geo., Director for Enduro Metals, a Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

About Enduro Metals

Enduro Metals is an exploration company focused on it’s flagship Newmont Lake Project; a total 618km2 property located between Eskay Creek, Snip, and Galore Creek within the heart of northwestern British Columbia’s Golden Triangle. Enduro Metals entered into an option agreement to acquire 436km2 from Romios Gold Resources who has carefully amalgamated the area since 2005 from a number of smaller operators. Remaining terms on the option agreement are a $1,000,000 CAD cash payment, and issuance of 8 million common shares of Enduro Metals to Romios Gold Resources. Romios will retain a 2% Net Smelter Returns Royalty (NSR) on the Newmont Lake Project, or on any afteracquired claims within a 5 km radius of the current boundary of the project, which may be reduced at any time to a 1% NSR on the payment of $2 million per 0.5% NSR. The remaining 182km2 is owned 100% by Enduro Metals and was acquired via staking. Building on prior results, the company’s geological team made several significant discoveries during its initial exploration program in 2019. A gold-rich copper porphyry outlined on the Burgundy Trend has striking similarities to large-scale deposits in the region, including the Red Chris deposit for which Newcrest last year paid US$807 million for a 70% interest. Chachi, a newly discovered area, generated high-grade samples of gold, silver, lead, zinc, nickel, and cobalt over a 9km x 4km area with associated geophysical responses. Diamond drilling in 2019 at the NW Zone demonstrated that the historic gold resource remains open laterally and to depth.

Work in 2020 will seek to further extend the known gold deposit and to investigate the large-scale discovery potential of multiple targets and deposit types.

On Behalf of the Board of Directors,

ENDURO METALS CORP.

“Cole Evans”

President/CEO

Email: info@endurometals.com

For further information please contact:

Investor Relations

Sean Kingsley – Director of Communications

Tel: +1 (604) 440-8474

Email: info@endurometals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement

This news release contains statements that constitute “forward-looking statements”. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause Enduro’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur.

Forward-looking statements in this document include statements concerning Enduro’s 2020 exploration and work programs and all other statements that are not statements of historical fact.

Although Enduro believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by their nature forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; adverse industry events; future legislative and regulatory developments in the mining sector; the Company’s ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of Enduro to implement its business strategies; competition; and other assumptions, risks and uncertainties.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.